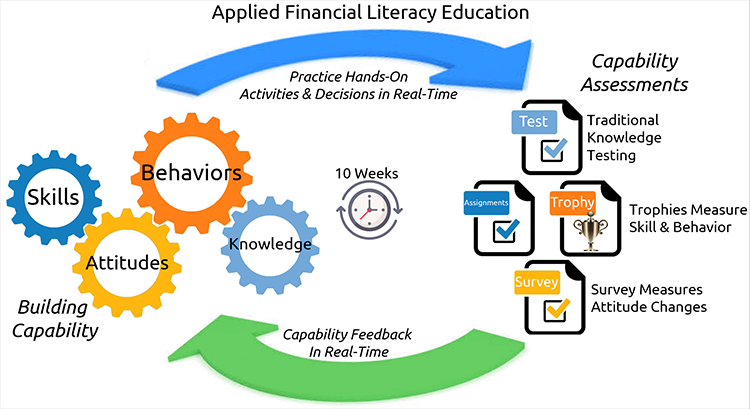

Budget Challenge teaches financial capability, not just knowledge. During our patented 10-week simulation, students are able to practice money management skills and receive real-time feedback that impacts their behaviors and attitudes. They also apply concepts from Personal Finance, our included 17 chapter companion e-textbook, creating learning that lasts.

Budget Challenge overcomes traditional classroom limitations by utilizing hands-on learning, which is the backbone of CTE (career and technical education). This means that Budget Challenge focuses on learning-by-doing and teaches students how to be financially capable young adults. Read more about how Applied Financial Literacy Education takes learning about ALL aspects of financial literacy (Knowledge, Skills, Behaviors & Attitudes) to the next level.

Download "Case for Applied Financial Literacy Education"