Credit unions have a mission to serve their community's financial needs.

Schools have a mission to create financially capable young adults. As First Area Credit Union begins its fourth year of Budget Challenge sponsorship, COO Lynn McCoy and Swan Valley Michigan High School teacher David Dawson share how they are transforming lives through their joint efforts. Read about it in this week's blog post.

David Dawson a Teacher at Swan Valley Michigan High School shares his students' experience with Budget Challenge and how it is shaping them into financially capable adults.

What has been your favorite part of the Budget Challenge as a teacher?

My favorite part of Budget Challenge as a teacher is the hands-on, real-world experience the students get over the course of the 12 week trimester. It's a simulation, but as close to actually paying bills and managing a budget as you can get. It forces them to learn, organize, think about the future, and react to unplanned events.

Why is it important to have sponsorship for your school?

It's important to have sponsorship for our students because without it, they wouldn't have this experience that carries over to their world after graduating from high school.

How do students engage with Budget Challenge differently from traditional materials?

Students engage with the learning material and directly apply it to what is happening in the simulation each day. Unlike static traditional learning materials, the simulation is dynamic and forces students to use the knowledge, concepts, and skills they learn and develop to solve problems in order to meet their financial goals.

What is the biggest challenge as a teacher or for your students when using Budget Challenge?

Some students become frustrated with how dynamic and real-world the simulation can be. Stuff happens. Sometimes you, or a spouse, or your kids end up with expenses or costs that you did not anticipate. How do you adjust? By helping them learn to expect the unexpected, and then how to positively work through a solution to stay on track, you help them develop the real-world skills necessary to be successful after high school.

Do you have a Budget Challenge story that is especially memorable?

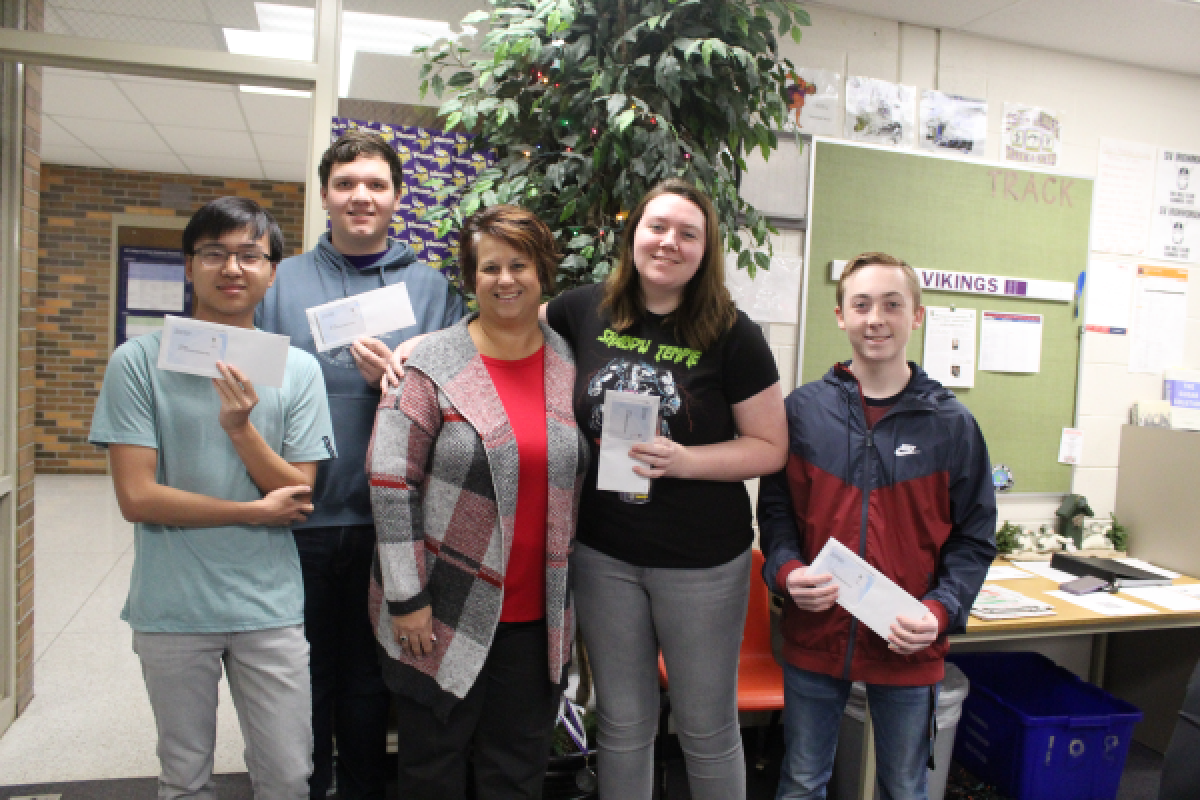

Some classes that get way too competitive and students telling classmates the wrong pay dates and amounts for bills to try to throw them off. That could be construed as not super positive, but it forced everyone to stay on their toes and check AND recheck dates and amounts. Also, I really enjoy having the students that have the top score in each class period getting their picture taken with Lynn and put in the district media outlets.

Lynn McCoy the COO of the First Area Credit Union shares the impact that being a sponsor has on the organization.

Can you tell me a little about your credit union and how it was formed?

We were formed in 1961 in two small classrooms within Holy Spirit Parish Church. Business was conducted on Sundays after church and even in the basement of Mr. Yockey’s home who was the CEO at that time. We eventually outgrew the two classrooms and purchased land to build a new credit union building. At that time we applied for a community charter and changed our name from Holy Spirit Parish Credit Union to First Area Credit Union in 2001. In 2005 we opened a second branch in Hemlock and have been growing ever since.

Have you had the opportunity to see the program? If so, what features do you like the most?

Yes I have. I try to visit Mr. Dawson’s class at least once a month, sometimes more depending on my schedule. I like that it simulates real life situations and teaches the students how to be responsible with managing their funds.

Why did you decide to sponsor Budget Challenge for Swan Valley schools?

They are the only high school located right by us. Many within the Swan Valley community are already members so it made perfect sense to start with the younger generations. Children learn from watching their parents behavior patterns which includes spending money. If their parents are not responsible with budgeting, then chances are that child won’t be either, so by starting financial literacy early we can get them on the right track of being financially responsible adults.

What impact has your sponsorship had on your organization?

Not sure. I do it for the pure joy of teaching the younger generation in hopes that they will be financially responsible after graduation. Many of the students become members so that’s a bonus.

What is your main objective as a sponsor?

To prepare students to be financially responsible adults.

Did you have financial literacy in high school?

No, our school only had accounting classes.

Did that affect your decision to sponsor the program in any way?

No, it was seeing adults coming into the credit union that had no idea on how to balance a checkbook, overdrawing their accounts from not budgeting their funds and bouncing checks and not understanding how it all works.