It is now mid-summer 2021 and this blog post is about how we designed and built not just a better stock market game, but the most innovative tool for teaching effective investing. We performed a complete tear-down and rebuild of the classic stock market game with the belief that we could correct its obvious issues and optimize the experience for helping students’ financial futures. One of the biggest differences is we treat investing as an activity supported by budgeting and saving skills, not an independent activity supported by fantasy money. We will take you under the hood on our journey to create our PLUS Investing component of Budget Challenge.

Educational programs are typically designed around a specific set of objectives or learning outcomes. When designing a new stock market game, PLUS Investing, we took a step back to look at more than the objective of students learning how to invest. We also looked at the real problems facing young adults in the real world. A quick internet search can turn up several lists of top problems/mistakes made by young investors.

Investing rates in young adults aged 18-29 years old are estimated at 25%. This means that 75% of young adults are not investing, making #5 ‘Not Investing’ clearly the largest real-world issue with young adults.

‘Problems’ are often ‘opportunities’ in disguise

By designing PLUS Investing to focus on the largest opportunities for young adults, we have optimized the program for improving students’ future financial lives, not just test scores. This is the difference between ‘education for education’s sake’ and ‘education to benefit students’.

Designing to make a difference

So, the challenge before us is to design a stock market game that reduces the likelihood of students making early investing mistakes. Using the 80/20 rule, we can make the largest impact on the financial outcomes of students by concentrating our focus on increasing early investing. We made some deliberate design choices to maximize this outcome.

Design theme #1 – Teach simple, automated, low-effort, long-term investing FIRST

It has been long debated in the investment community on whether long-term index fund investing outperforms managed funds and active trading. There are two important things to note about this debate, regardless of which side you take.

1) BOTH approaches perform very well.

2) Passive investing is simpler and takes far less effort.

Active investing is so complicated, technical, and time consuming that seasoned professionals with advanced certifications can spend 100% of their job doing analysis, crunching numbers, and timing their trades. Very few people have the time or desire to be an active trader. So, if you are looking to increase the likelihood of students becoming early investors, do you teach an effective way that is ‘complex and time consuming’ or an effective way that is ‘simple and easy’? The answer is clear to us.

So, what does ‘simple and easy’ look like? Our stock market game is entirely contained inside a simple and relatively boring tax-deferred retirement account. We do not include single-stock trades, day-trading, options trading, or trading on margin. Why? In order to have a secure financial future, students will not have to learn how to buy and sell individual stocks. But they will have to learn how to successfully invest for retirement. In addition, experts advise people to max-out tax-deferred investing FIRST. For example, if you have a 401(k), the first $19,500 THAT YOU SAVE EACH YEAR should be invested here. Because it is a retirement account, contributions immediately reduce your taxable income. Capital gain taxes on earnings are deferred until funds are withdrawn allowing the full power of compounding to occur. Tax-deferred retirement account are simple because they have a limited choice of well-diversified investments to choose from. This reduces decision- making fatigue and makes asset diversification nearly automatic. Contribution from payroll are automated making investing as easy as set-it and forget-it. Another benefit is that over 90% of employers match a portion of their employees’ contribution. An employer match is truly free money and generates an immediate positive return-on-investment, yet a recent study found that 42% of employees earning under $40,000 per year do not take full advantage of their employer match.

Design theme #2 - Set healthy expectation about long-term investing

Long-term investing requires belief and commitment. Belief in the power of compounding over a long period of time, and commitment to an investing strategy that is often tested by market swings. A young adult’s belief and commitment can be significantly impacted by early experience with investing.

- If returns of early investing are too positive, later disappointment can increase risk of quitting.

- If returns of early investing are too negative, then a young adult may never become an investor.

One of the major problems of stock market games is they inadvertently teach the wrong lessons. A short-term simulation that focuses on the performance of individual stocks is inherently flawed. The flaw is that the biggest factor in short-term market performance is luck. The few students who “get lucky” and pick big winners may conclude that speculating in stocks is an easy way to make big money. This gambling-inspired form of investing is gaining popularity on trading apps like Robinhood, often with disastrous consequences. The many students that “didn’t get lucky” may conclude that they have low stock-picking skills and should either avoid investing or pick overly conservative funds. This is also cause of concern because avoiding equities in retirement accounts can cost students millions of dollars in lost returns.

We correct for this flaw in our design by using randomly selected periods of real historical data instead of live data. We price-normalize historical market data from 2005-2015 so that all prices ‘feel’ current and so that students can’t gain a trading advantage by figuring out ‘when’ the data is from. This provides the realistic feel of how stock markets behave without exposing students to the risk of showing an abnormally good or bad market during the simulation. The pool of historical periods that we randomly select from all contain interesting volatility, but also have a small positive gain that is realistic when annualized.

Healthy expectations about long-term investing will not only increase the number of young adults that start investing, but it will also help reduce the number that quit after starting.

Design them #3 - Reward the right behaviors

The closer someone gets to retirement age, the more complicated investing advice becomes, and the more experts don’t agree. But the opposite is true for young adults. The younger the investor is, the more experts agree. Here are the top behaviors recommended by experts for a young adult.

- Invest fully (majority of portfolio is in funds, not cash or money market)

- Invest aggressively (with long investing horizon, invest in mostly aggressive funds)

- Take full advantage of an employer match (take the free money)

- Avoid fees (avoid expensive funds)

We designed three trophies in PLUS Investing to reward the long-term investing behaviors most endorsed by experts. Rewarding the right behaviors is important but rewarding every student that does the right thing is even more important. This is a significant improvement on the classic stock market games where the focus is on winning instead of practicing the best behaviors. We believe that this approach will build more investing confidence in young investors and will ultimately lead to an increase in the number investing.

Design theme #4 – Promote realistic, sustainable investing

It happens all the time. A young adult needs to liquidate their savings, or worse a retirement account for some reason or another. It is a painful and frustrating experience to watch months or even years of savings get quickly erased. These setbacks are more common and even predictable when people attempt to save money without the financial foundation to make investing sustainable. In spite of this, most stock market games begin with the premise that the student has been given $100,000 to invest. Unfortunately, this reinforces the fantasy of easy money, get rich quick investing. For economically and socially disadvantaged students, the whole experience seems like another thing that has no relevance to their actual lives.

At Budget Challenge, we see investing as an activity that is ONLY possible by mastering two other activities, budgeting and saving.

At Budget Challenge, we see investing as an activity that is ONLY possible by mastering two other activities, budgeting and saving.

Because of this, we designed PLUS Investing with another important difference. Students can continue to contribute to their retirement account throughout the 10-week simulation. Students that can save more in their budget can increase the bi-weekly contribution amount from their paycheck. This establishes a strong connection between budgeting, saving, and investing. Also, when we rank students by portfolio value, the students at the top often make higher contributions in addition to making good investment decisions. In Plus Investing, the best investors are also the best savers. It is a lesson that needs much attention.

Design theme #5 – Show how early investing makes a BIG difference

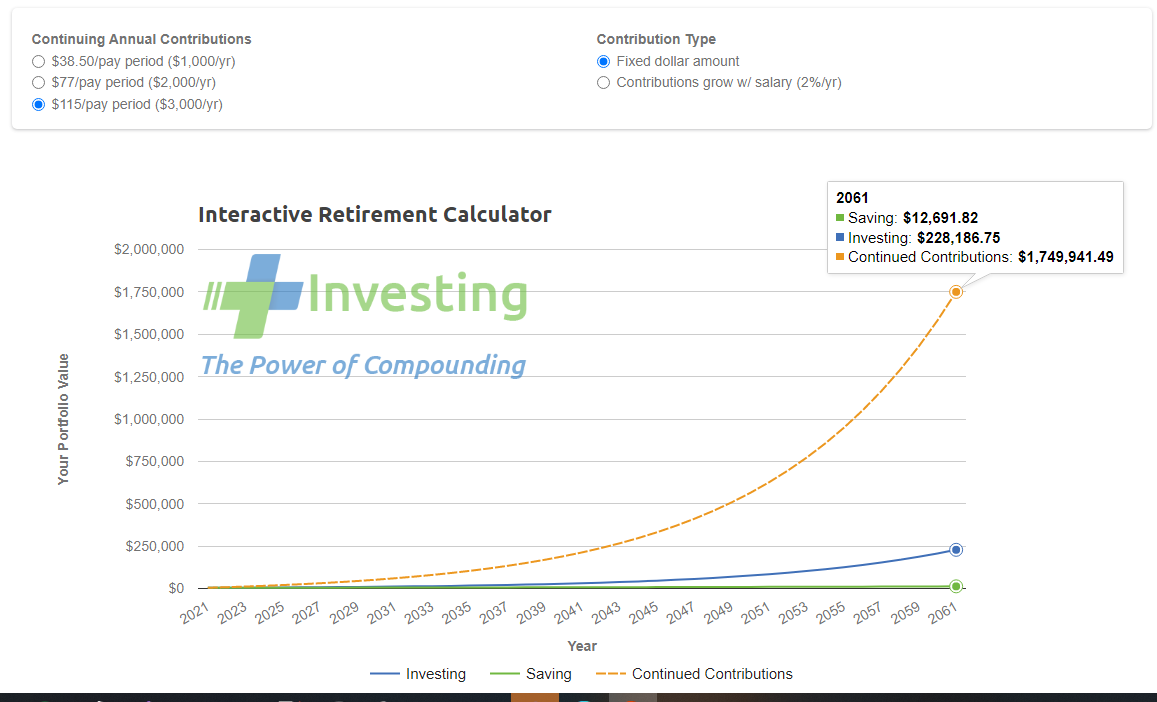

The power of compounding is undeniably huge, even with small amounts of money to invest. In the classic stock market games, students are introduced to investing with a fantasy $100,000 to invest. While it is fun to imagine managing this large amount of money, it also paints a picture of what investing should look like. Fast-forward to a student’s first paycheck and what small fraction of that income that might go to retirement investing. The contrast is so large between this small part of a paycheck and $100,000 that it is easy to imagine young adults thinking “why bother? I’ll never have enough money to start investing”.

In PLUS Investing, students can make realistic retirement contributions from a realistic paycheck. This helps establish the habit of making regular contributions and how to use automated payroll deductions to make it easy. At the end of the 10-week simulation, we graph each student’s ending portfolio balance out 40 years into the future to show the power of compounding. ‘Seeing Is Believing’, and this graph is a powerful tool that will positively help young adults visualize this amazing benefit and start investing sooner.

PLUS Investing takes aim at the biggest problems facing young investors to make a real impact in the lives of our students. The classic stock market games teach knowledge and skills that aren’t needed by students nor recommended by experts. The advocacy of complex short-term investing, outside a retirement account, with fairy tale amounts of money is simply discouraging to young investors. It is time for investing education to focus on helping students invest and improving outcomes for young adults.