In this “Under the Hood” post, we will look at the trophies and the design thinking behind them. Before Budget Challenge had trophies, we sometimes received feedback indicating that students and teachers were uncertain about what to focus on or prioritize. While this might be a common sentiment in the adult world of personal finance, it was a clear sign that there was an opportunity to improve the simulation. The question was how best to focus on the essential personal finance behaviors in the simulation. As it sometimes is in life, one needs to zoom out first to improve focus.

Many people can point to a handful of books that influenced how they view life. For me, one of those books was Steven Covey’s, The Seven Habits of Highly Effective People. The entire book is excellent, but the introduction contained something profound and valuable to me for gaining focus. Covey takes the reader through a mental exercise of imagining you are attending a funeral, a funeral for yourself. The exercise guides you to look at yourself after everything you could have done in your life is over and to imagine what others might be thinking.

Then, imagine what you might be thinking.

For me, this was one of the best exercises for separating the noise from what really matters, which can prove to be a fantastic guide on how to spend one's time. I applied this thinking to the new design project of creating focus through trophies.

I asked the question: What would a former Budget Challenge student, who is now an adult, want to have learned from the program?

My Answer: The former student would want to have learned to perform all aspects needed in their adult financial lives, from budgeting through retirement investing. In short, they would have wanted to develop financial capability. This financial capability would significantly improve their quality of life by reducing the pain of making costly financial mistakes.

What do adults struggle with financially?

Though I was aware of many financial issues adults struggle with, I decided to do some additional research to be thorough. My list of topics quickly expanded: no retirement savings, high credit card debt, high student loan debt, poor education on mortgage products, past due auto loans, low personal savings rate, no emergency funds, being underinsured, low credit scores, delayed home ownership, living paycheck to paycheck, not knowing how to budget, and bankruptcy. As the list grew, it became clear that these widely varied problems had some common root causes.

Identifying root causes in capability

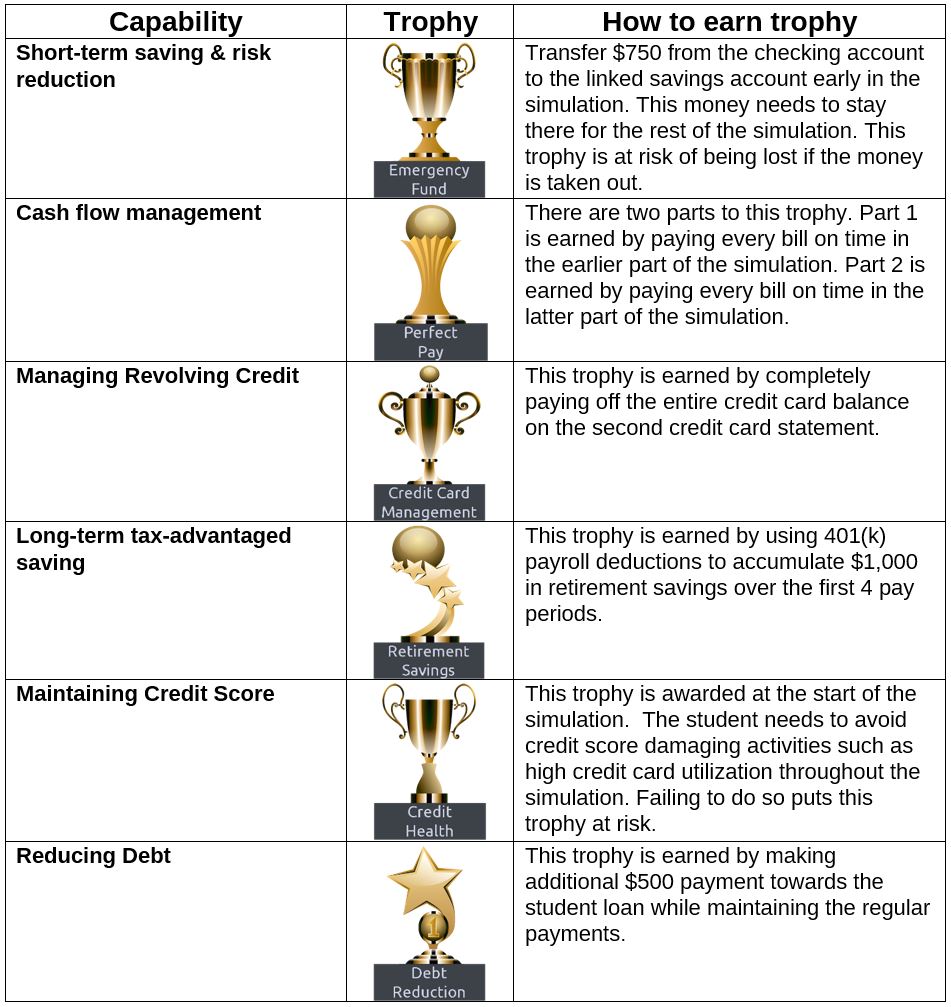

After much analysis and reflection, I developed a list of the top six essential behaviors of financial capability. Each would have its own trophy that could only be earned by demonstrating it in the simulation. Below are the six capabilities, their corresponding trophies, and how they are acquired.

Timing of deadlines in the simulation

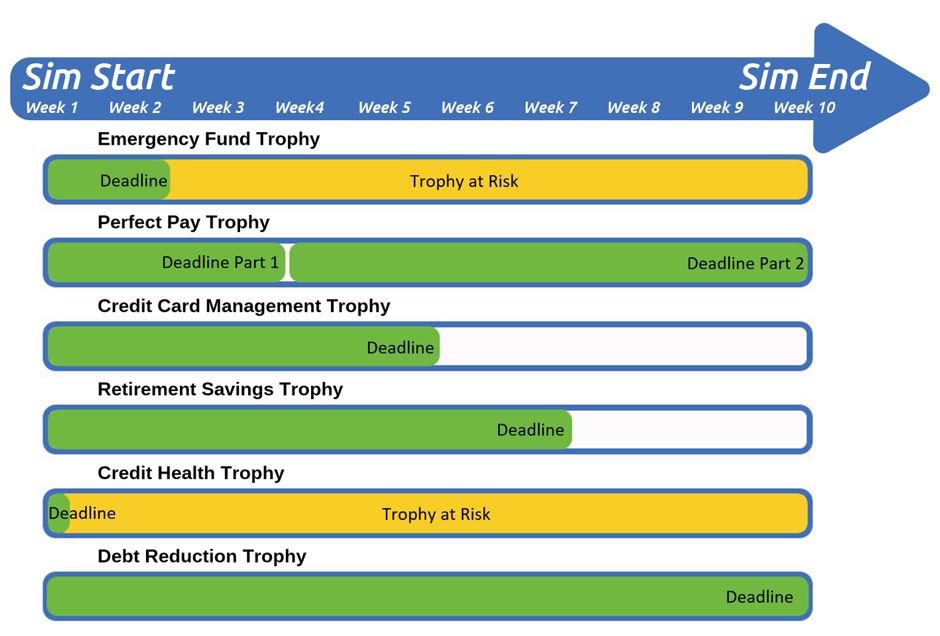

The trophies have staggered deadlines throughout the simulation. This design choice results in several benefits. Early wins in the simulation help build student confidence and increase motivation and engagement.

The spacing of the deadlines helps teachers manage the topics they need to cover in class. Lastly, variable trophy deadlines also allowed us to create an implied order to earn trophies that students could model in the real world.

Trophy overlap and tradeoffs

Traditional lessons typically teach one aspect of personal finance at a time, in isolation. Until Budget Challenge, there has been no way to show a student how financial goals often compete with one another. The most powerful design feature in the entire simulation may be having many trophies open simultaneously (see below). Because of this, students feel the stress from making difficult decisions involving tradeoffs. Just like in life, if you pay down a credit card, you cannot use that same money to pay down student debt. Students also experience how interconnected money decisions can be in the real world.

Elevated point values

The value of each trophy being 1,000 points emphasizes their importance. Earning trophies significantly affects class ranking. This high point valuation aligns with the focus.

Setting a high standard means students are more likely to be successful in life

Budget Challenge always strives to be as realistic as possible. In most schools, financial literacy is taught as a one-time intervention. So, for most students, we only get one opportunity to prepare them for the unforgiving realities of the real world. With this end in mind, creating financially capable young adults, we developed these six trophies. So far, the feedback we've received has been overwhelmingly positive. We sometimes get requests for a simpler, easier version of our program. Successfully managing adult finances is neither simple, nor easy. Even capable adults have to make difficult trade-offs all the time. Though students often tell us our program is fun, we did not name it “Budget Fun”. We immerse students in the full, complex realities of managing adult finances, allow them to experience frustration, make mistakes, and learn from them. That is what makes our program so effective and why it produces Learning That Lasts®.