At Budget Challenge, we pride ourselves on listening to teacher and student feedback and improving our program each year. This year is no different, so here's a quick overview of what we have in store for the 2023-24 school year.

Updated textbook: Personal Finance is the most up-to-date resource with the latest statistics, figures, and topics.

Real World Activities and Readings: Textbook chapter resources now include Real World Activities and Readings, providing deeper learning experiences on vital topics. PDFs can be easily reproduced or converted to assignable Google forms.

Plus Investing Retirement Projection Tool: After the 4th paycheck, a 401(k) retirement calculator will appear in students 401(k) account under the Employer tab. It will show them the value of their current investments after 40 years and the value of continued investing based on their elections. It can also model returns at different % contributions.

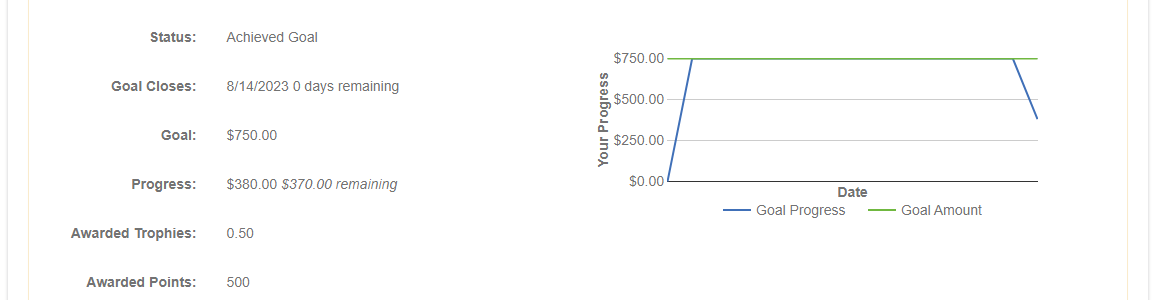

Emergency Fund can now be used for emergencies: We've heard your feedback and have updated the Emergency Fund trophy goal so that students can use their emergency fund. Daily penalty and reward points will apply to more accurately reflect financial health. Here's an in depth look at the updated rules for the Emergency Fund goal.

During the simulation, you may use your emergency fund for unexpected expenses or budget shortfalls. After earning the trophy, students can

- Give up half the trophy and trophy points to use up to $375.00 of the emergency fund.

- Give up the entire trophy and trophy points to use $375.01-$750 of the emergency fund.

The trophy and trophy points are restored when your savings account balance equals or exceeds $750.00. Returned trophies and points are permanently lost if your savings account balance is below $750.00 at the end of the simulation.

In order to incentivize replacing the money used in students' emergency funds, there are new daily penalty and rewards.

3 Point Daily Reward for maintaining $750 or more in your savings account. This daily reward is active throughout the entire simulation.

3 Point Daily Penalty for having between $375-750 in your savings account. This daily penalty starts on Day 12, after the close of the Emergency Fund Trophy.

5 Point Daily Penalty for having less than $375 in your savings account. This daily penalty starts on Day 12, after the close of the Emergency Fund Trophy.

Regardless of whether the Emergency Fund Trophy is earned, savings account reward and penalty points are assessed.

More flexibility for year-long classes: The program now allows year-round textbook and quiz use. For more information on how to expand access, read our previous post on scheduling features.

Improved student videos: The Earning Trophies video series has been re-created to provide helpful instruction before the simulation starts. These videos have been included in each goal's description on student home as well as on the Videos page.

In the Works

Teacher Financial Literacy Certification: The Foundation for Economic Education will soon provide financial literacy training and certification at no cost to eligible teachers. They have selected Budget Challenge to provide the educational resources for instruction. Consequently, Budget Challenge teachers will receive priority access to this exciting opportunity.

Chapter Presentations: Powerpoint & Google Slides presentations for all 17 chapters of the Personal Finance textbook.

Streamlined Leaderboard: The current leaderboard contains a mix of ranking and activity statistics with a separate leaderboard for +Investing. The update will merge the Budget Challenge and +Investing leaderboards and create a new student activity center.

Class vs. Class Competition: New profile settings will allow teachers to opt-in to class vs. class rankings

Account status: Teachers will be able to see their account status, including student licenses available for use.